Interest Rate Models - Notes

Key Concepts

Interest rates

Simple

Compound

Short rate

Term structure dynamics

LIBOR

Yiel curve

Cupon Bond

Cash Flow

Borrower time

Pricing interest rate derivatives

Money Market Account

Zero-Cupon Bonds (dicount bond)

Discount curve

Term strcuture and yield curve

Modeling and term struture dynamics

Money Market Account

# Forward rate function under continuous compounding - ZERO Cupon

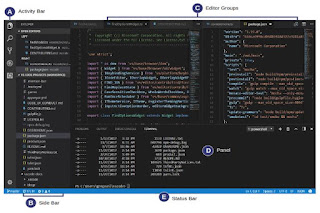

forward_rate <- function(y1, T1, y2, T2) {

P1 <- exp(-y1 * T1) # Price of zero-coupon bond maturing at T1

P2 <- exp(-y2 * T2) # Price of zero-coupon bond maturing at T2

F <- (P1 / P2)^(1 / (T2 - T1)) - 1

return(F)

}

# Example: yields and maturities

y1 <- 0.04 # 4% for 1 year

T1 <- 1

y2 <- 0.06 # 6% for 2 years

T2 <- 2

F_0_1_2 <- forward_rate(y1, T1, y2, T2)

cat("Forward rate F(0,1,2):", round(F_0_1_2 * 100, 2), "%\n")

Coupon Bonds and Interest Rate Swaps

Sintetic create long term invesments.