Financial Markets - Key Notes

Key Notes of Derivatives Markets – (McDonald, 2013)

Chapter 2 – An Introduction to Forwards and Options

- forward contracts

- call options

- and put options

2.1 Forwards Contracts

Forward contract: It sets today the terms at which you buy or sell an asset or commodity at a specific time in the future. A forward contract does the following:- Specifies the quantity and exact type of the asset or commodity.

- Specifies delivery logistics (time, date, and place).

- Specifies the price.

- Obligates the seller to sell and the buyer to buy.

Key concepts:

- expiration date

- underlying asset

- premium

- spot price

- Zero-Coupon Bonds

- credit risk

- payoff

Chapter 5 – Financial Forwards and Futures

The purchase of a stock or other asset entails agreeing to a price, making payment, and taking delivery of the asset. A forward contract fixes the price today, but payment and delivery are deferred. The pricing of forward contracts reflects the costs and benefits of this deferred payment and delivery.

The prepaid forward price is below the asset spot price, S0 , due to dividends forgone by deferring delivery.

A forward contract is equivalent to a leveraged position in an asset—borrowing to buy the asset.

The forward price is therefore a biased predictor of the future spot price of the asset, with the bias equal to the risk premium.

The fact that it is possible to create a synthetic forward has two important implications. First, if the forward contract is mispriced, arbitrageurs can take offsetting positions in the forward contract and the synthetic forward contract—in effect buying low and selling high— and make a risk-free profit. Second, dealers who make markets in the forward or in the underlying asset can hedge the risk of their position with a synthetic offsetting position. With transaction costs there is a no-arbitrage region rather than a single no-arbitrage price.

Chapter 6 - Commodities Forward and Futures

logic of forward pricing for financial assets. We will see that understanding a forward curve

generally requires that we understand something about the underlying commodity.

Key concepts:

- commodities

- financial assets

- synthetic commodities (combining commodity futures and default-free bonds -is financially preferable to invest in a synthetic rather than a physical commodity.).

- cash-and-carry

- carry market

- lease rate—the return that makes an investor willing to buy and then lend a commodity.

- lease payment

- risk-free rate

- profit

- arbitrage

- dividend yield

- commodity’s convenience yield (nonmonetary benefits from physical possession of the commodity).

- Forward curves

- differences between commodities and financial assets:

Commodities and Financial Assets:

- For both commodities and financial assets, the forward price is the expected spot price discounted at the risk premium on the asset.

- Storage of a commodity is an economic decision in which the investor compares

the benefit from selling today with the benefit of selling in the future. - When commodities are not stored, the forward price reflects the expected future spot price.

- Forward prices that are too high can be arbitraged with a cash-and-carry, while forward

prices that are lower may not be arbitrageable, as the terms of a short sale should be based on

the forward price. - The commodity’s convenience yield can lower the forward price.

Differences Between Commodities and Financial Assets

- Storage costs (the cost of storing a physical item and deterioration over time).

- financial securities are inexpensive to store - don't applied for financial assets.

- Carry markets (a commodity for which the forward price compensates a commodity

owner for costs of storage). - financial markets are always carry markets: Assets are always “stored” (owned), and forward prices always compensate owners for storage.

- Lease rate.

- In the case of financial assets, short-sellers have to compensate lenders for

missed dividends or other payments accruing to the asset. - For commodities, a short-seller may have to make a payment, called a lease payment, to the commodity lender.

- Convenience rate (may be receive by the owner of a commodity).

the effect of storage costs

Commodity Terminology

- Clasified as:

- extractive and renewable

- primary (unprocessed) and secondary (processed)

- contango and backwardation

Forward curve -yield- (upward sloping - contango)

External additional source:

Spot Price Conceptualization - CFI

The main difference between spot prices and futures prices is that spot prices are for immediate buying and selling, while futures contracts delay payment and delivery to predetermined future dates.

The spot price is usually below the futures price. The situation is known as contango. Contango is quite common for non-perishable goods with significant storage costs.

On the other hand, there is backwardation, which is a situation when the spot price exceeds the futures price.

In either situation, the futures price is expected to eventually converge with the current market price.

Bloomberg - Backwardation real escenario

Cause of contango:

- Inflation: Rising costs increase the costs of carrying

- Political instability: Supply system and trading routes get disrupted

- Weather: Crops may not grow or be harvested as anticipated

- Sentiment: Traders and investors can change their minds about the market

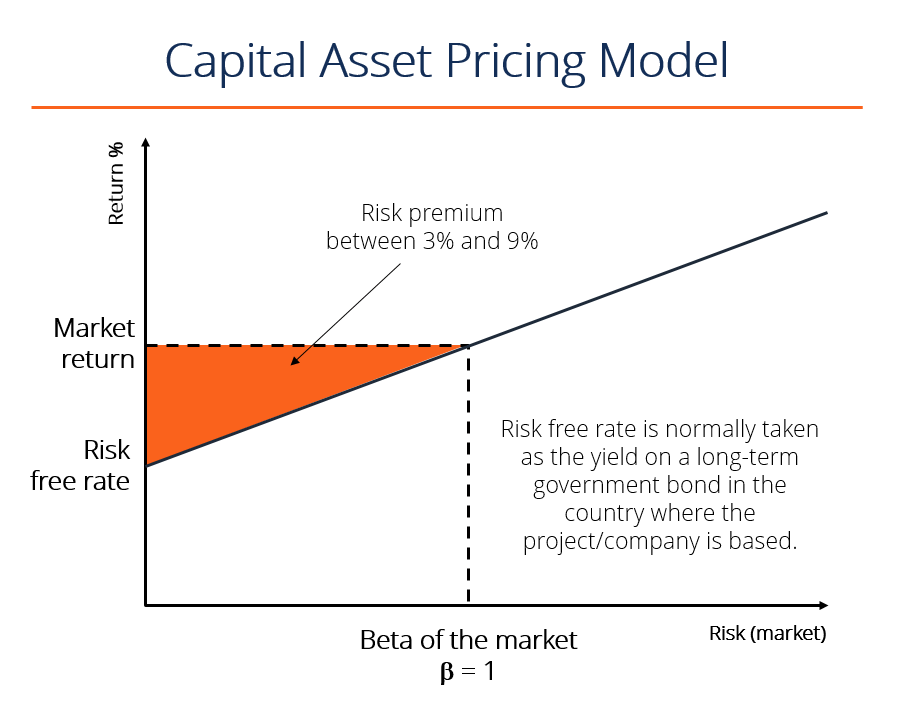

- risk-free rate, which is typically equal to the yield on a 10-year US government bond.

- The beta is a measure of a stock’s risk (volatility of returns - sensitivity to market risk)

Additional Resource:

Bibliography

McDonald, R. (2013). Derivatives Markets. 3er (International) Edition, Pearson.